What are Credit Protection and Credit Insights?

Keep watch over your credit with RentTrack's Credit Protection

When you activate your subscription and pass verification you will receive Credit Protection and Credit Insights. RentTrack will keep an eye on your credit report and alert you of any changes you should be aware of that might affect your score. This includes monthly updates to your VantageScore and credit profile. We'll also send you a notification whenever a new item is added to your credit report.

You'll be alerted of any new unauthorized or fraudulent accounts in your name so that you can shut them down before they affect your credit. It can also help you stay on top of negative credit information reported on your behalf so that you can respond or dispute any information that is inaccurate.

Occasionally, negative information in your credit score might be due to a bill you forgot to pay or were unaware of. For example, it could be a utility bill that was not canceled after you moved out. Getting alerts when these issues show up on your credit report allows you to contact the creditor, arrange for payment, and possibly get the information removed from your credit profile.

Additionally, Credit Protection allows you to see inquiries on your credit. Inquiries may be placed by potential lenders, employers, insurers, or landlords. Hard inquiries, such as those placed when you apply for a car loan, mortgage, or new credit card, can have a small negative effect on your credit, so it's important to make sure that no unauthorized hard inquiries occur. If they do, it may also be a sign of fraudulent activity.

Staying aware via alerts can help you spot trouble before it starts.

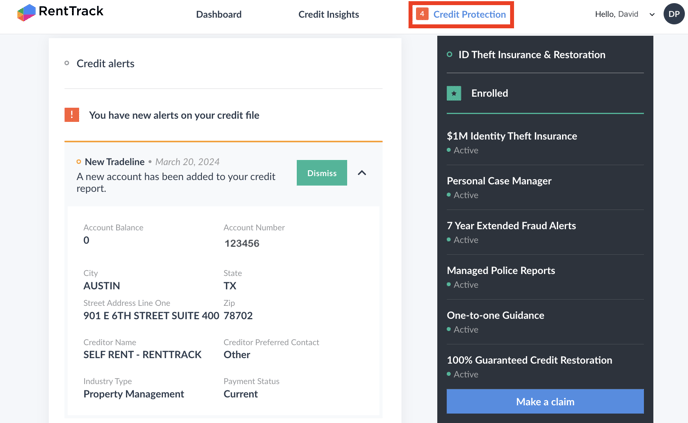

If you receive an alert, you can sign into RentTrack to find out more information about the creditor. Go to the Credit Protection tab, then click on the arrow next to the alert to view the details:

If you have questions, contact the company.

You'll receive alerts for the following changes made to your TransUnion® credit profile:

Bankruptcy: A bankruptcy was reported in your name

Derogatory Account: A serious new negative mark has appeared on your credit. This may be due to an unpaid account that has been sent to collections, or other legal action that has been taken against you.

Fraud Alert Added: An alert that lets potential lenders know you are a victim of, or at risk for, identity theft. If your personal data has been compromised in any way, it is wise to place a fraud alert on your credit.

Improved Account: Your credit has significantly increased. This can happen for several reasons, including if negative information is removed from your credit report.

New Account: A new credit account has been opened in your name. If you do not recognize the account, this could be an indication of fraud.

New Address: A new address has been supplied to a lender or creditor. If you do not recognize the address, this could be an indication of fraud.

New Employment: New information about your employment has been added to your record. If you do not recognize the employer, this could be an indication of fraud.

New Inquiry: A new inquiry was made on your credit. It may a hard (voluntary) inquiry, or a soft (involuntary) inquiry. Hard inquiries can negatively affect your credit.

New Public Record: A new foreclosure, suit, wage garnishment, or lien in your name is on public record.

Note that these are only changes to your TransUnion® credit profile, and may not reflect equivalent changes to other bureau credit profiles. If you receive an alert that you do not recognize, we recommend using www.annualcreditreport.com to pull your credit profile from all major bureaus and initiate any disputes.